cap and trade vs carbon tax ontario

Peter MacdiarmidGetty Images G r. In which how cap and trade can reduce.

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

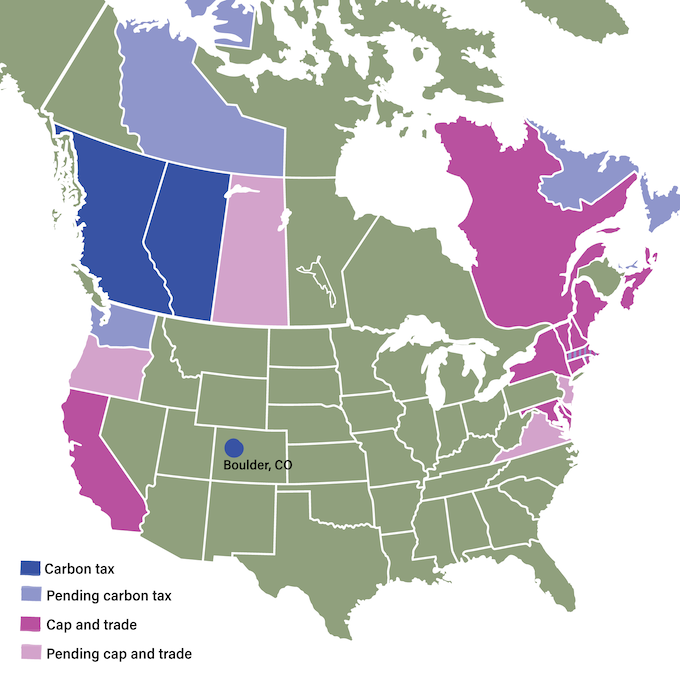

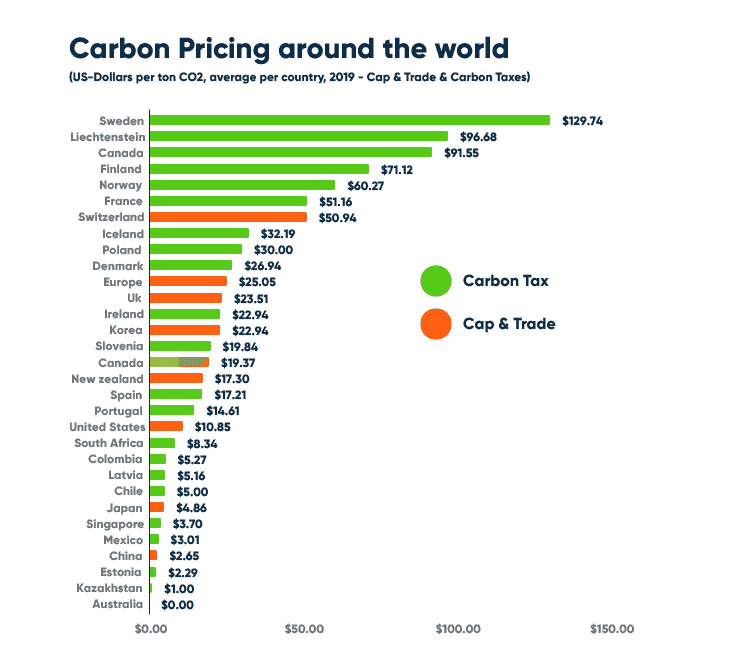

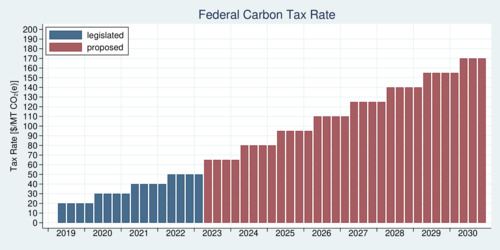

While the Liberals say its essential to have a carbon tax that will rise to 170 a tonne by 2030 Quebecs cap-and-trade plan currently equals a carbon price of just 17 a tonne.

. How Well Has It Worked. Finally the practicality of reducing emissions under a carbon taxation system is much more functional than the cap-and-trade program. Learn the basics of cap and trade Effective July 3 2018 we cancelled the cap and trade regulation and prohibited all trading of emission allowances.

The revenue generated from the taxation will also assist Canadians by ultimately facilitating greener practices by subsidization and funding environmentally conscious research. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. September 13th 2016 1021 PM GMT0000.

Critics blast government spending on court battle against federal carbon tax. No matter how much gets emitted a carbon tax makes the emission the same. Earlier this month Ontario Quebec and Mexico struck the first international climate change deal.

With cap-and-trade units of carbon are initially given out for free meaning there is no upfront cost to firms. Cap-and-Trade Versus Carbon Tax. With a carbon tax there is an immediate cost to.

Cap-and-Trade vs Carbon Tax. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at lower than expected costs and is. The advantage of a carbon tax compared with cap and trade is that it is relatively easy to administer and straightforward to understand.

Cap and Trade. The Ontario cap-and-trade system aims to reduce emissions by 15 per cent of 1990 levels by the end of 2020 and reduce emissions by 37 per cent of 1990 levels by 2030. What you need to know about Ontarios carbon market using a cap and trade program including how it works and who is required to participate.

Cap and trade. Cap-and-trade involves setting an economy-wide emissions limit for those sectors under regulation and. Carbon Tax vs.

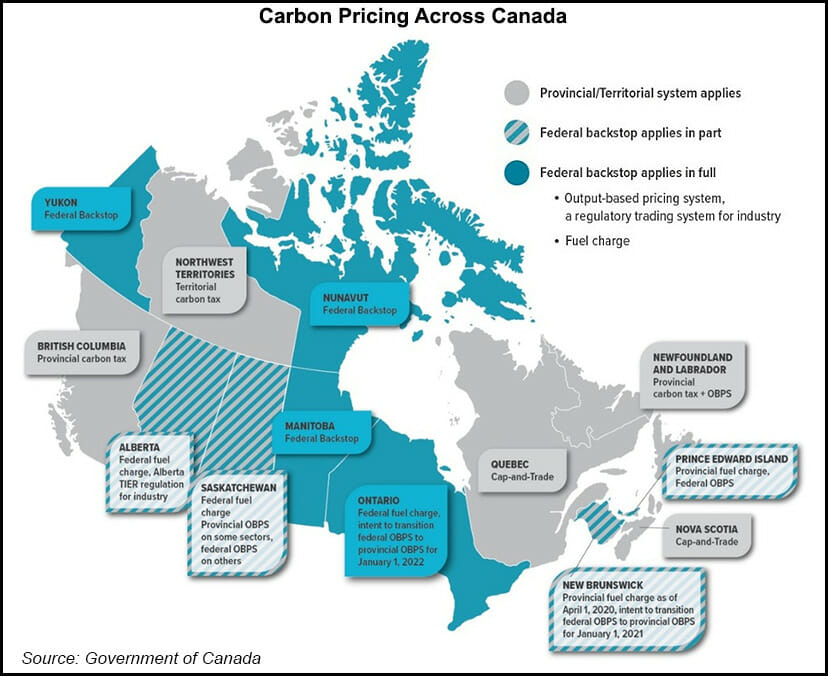

Additionally our experiment showed that emissions were 117 percent lower under the cap-and-trade scenario. Most of the rest of Canada either already has a carbon pricing plan or will have one. We have developed a plan to wind down the program.

Each approach has its vocal supporters. As an indicator of wider interest in cap-and-trade programs so central to Californias greenhouse gas reduction ambitions Ontarios defection is not ideal. Cap-and-Trade vs Carbon Tax.

Ontarios cap-and-trade system aimed to lower greenhouse gas emissions by putting caps on the amount of pollution. A carbon tax and cap-and-trade are opposite sides of the same coin. By Taras Berezowsky on April 15 2015.

The orderly wind down of the cap-and-trade carbon tax is a key step towards fulfilling the governments commitment to reducing gas prices by 10 cents per litre. No Clear Winner as Ontario Joins California. In 2017 Ontario will introduce a cap-and-trade system.

A carbon tax forces companies to pay a fixed fee per ton of greenhouse gas emissions GHG. A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a. However the main purpose of this paper is to rebut his argument and to present why Cap-and-Trade is a better solution compare to other solution in controlling variables ensuring social justice and last expanding global regulation on carbon dioxide.

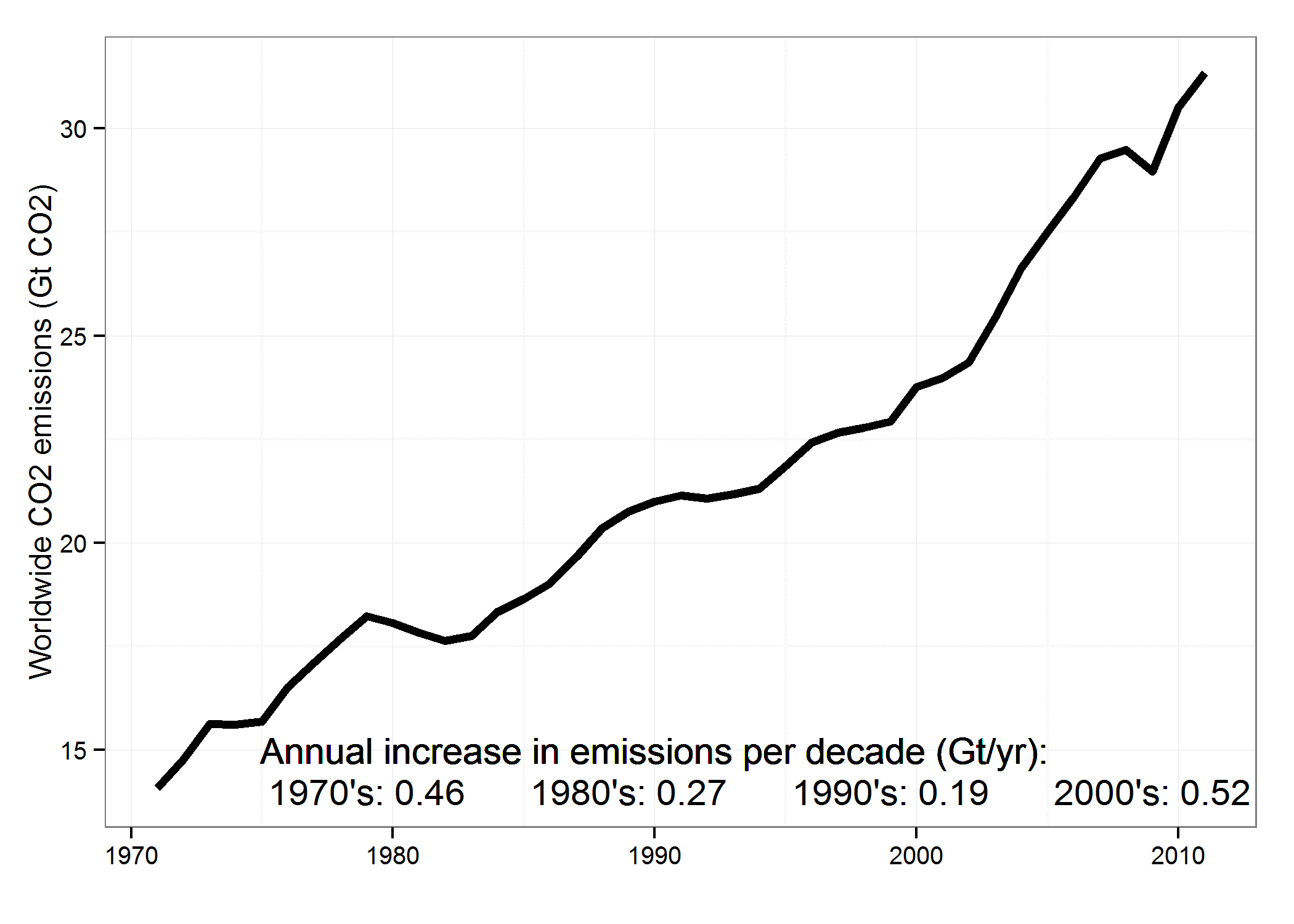

We have developed a plan to wind down the program. This was partly due to lower production volume overall but the bulk of the difference stemmed from the firms technology choice with greater adoption of the cleaner CCS technology under cap-and-trade than under the carbon tax setting. Manitoba had promised to join Ontario and Quebec in introducing a cap-and-trade system.

For businesses Effective July 3 2018 we cancelled the cap and trade regulation and prohibited all trading of emission allowances. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions. Today Environment Minister Rod Phillips announced the legal framework to wind down the program that if approved would help reduce gas prices by 10 cents per litre.

Learn more about the program and what it means for you and the environment. Argued that carbon tax is the less complex and better guarantee solution to carbon reduction. On October 31 Ontario passed the Cap and Trade Cancellation Act 2018 that officially removed Ontarios cap and trade program law from the books.

Ontario unveils cap-and-trade plans as provinces take. The total compensation amount is 5090000 for a total of 27 participants. Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences.

The Ontario Progressive Conservative Party announced its introducing legislation today to eliminate the cap-and-trade carbon tax in the province. Emissions trading or cap-and-trade CAT and a carbon tax are fundamentally different tools to limit the effects of using fossil fuels. Carbon taxes makes emitting carbon dioxide more expensive.

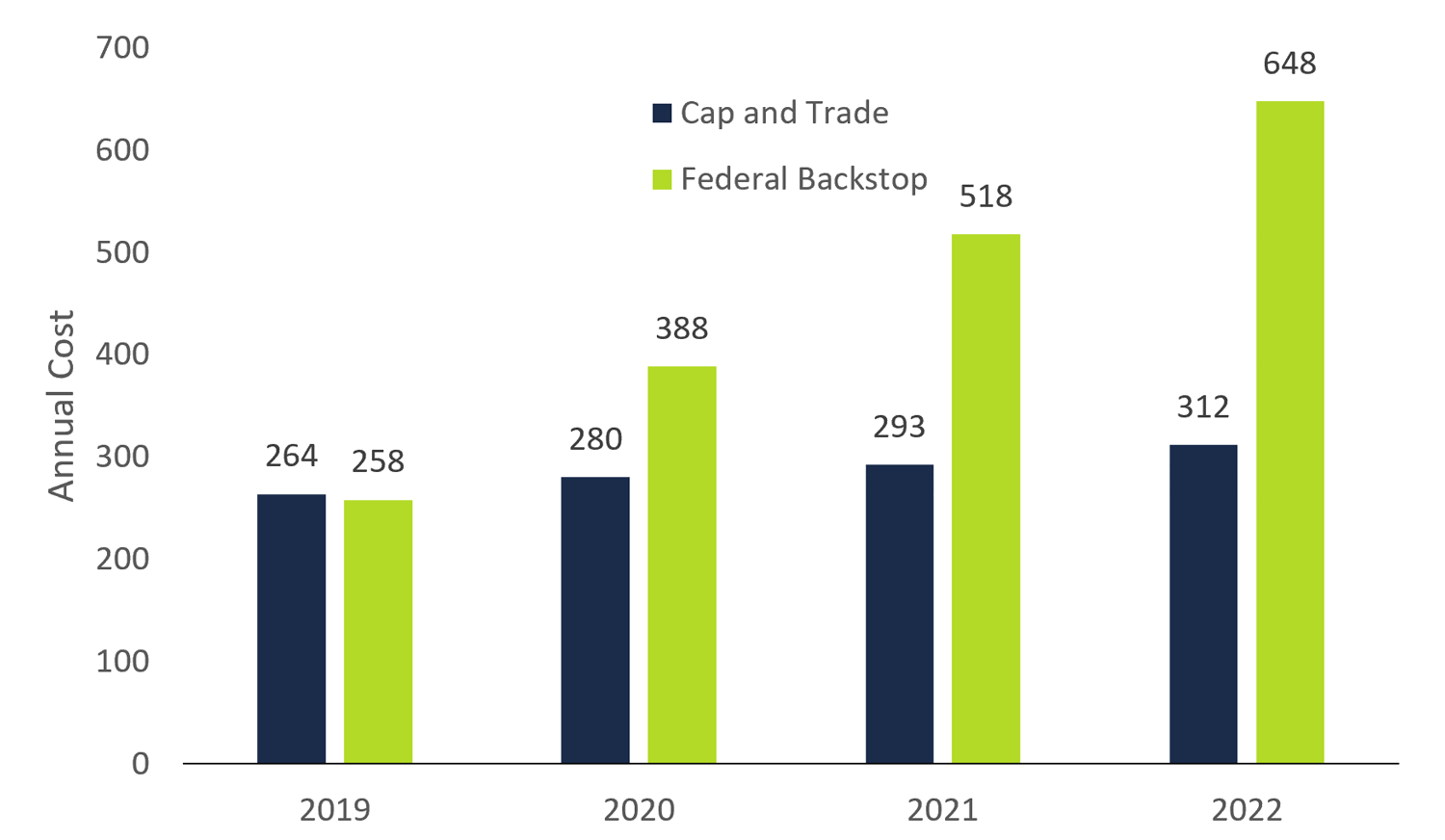

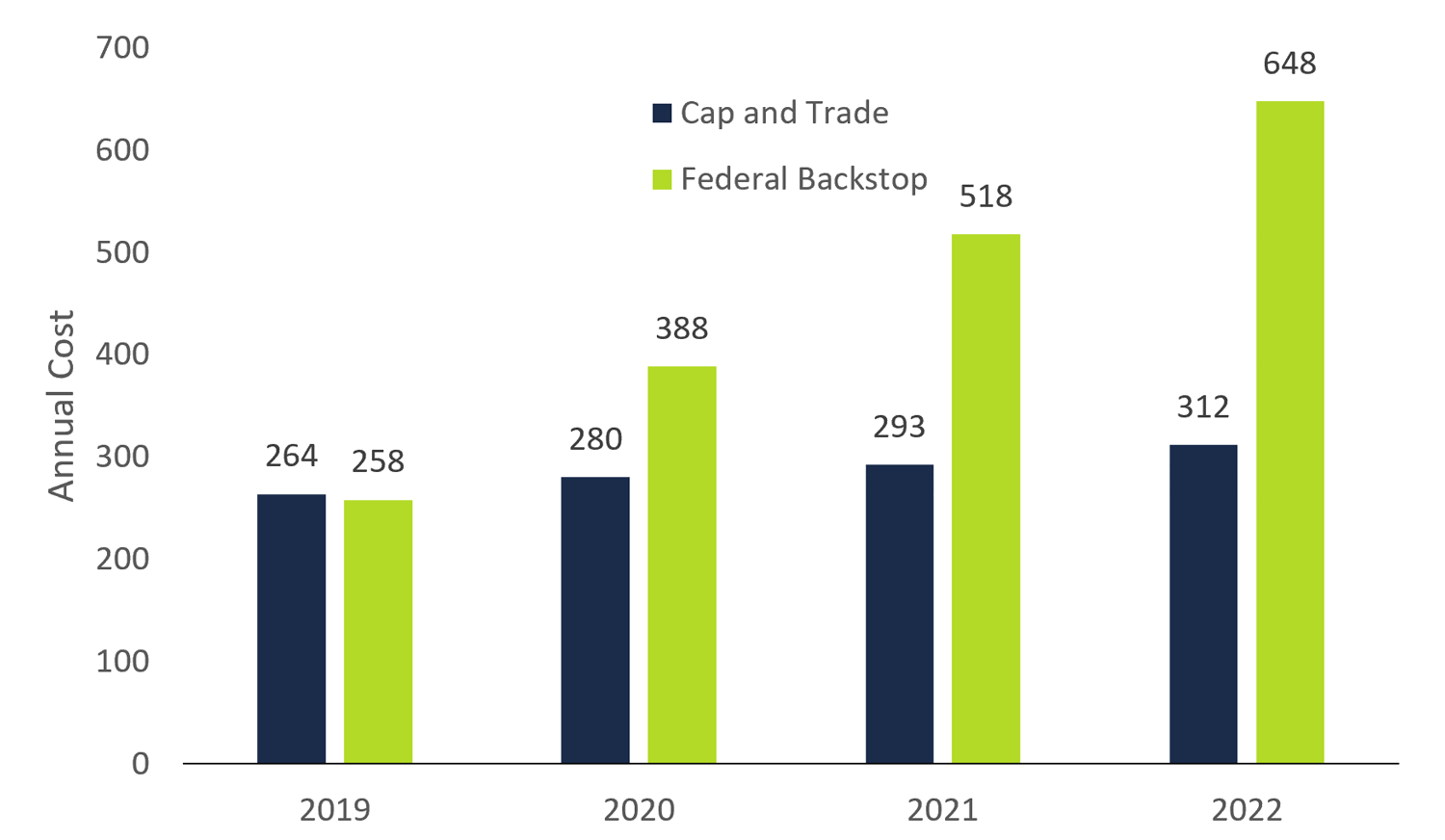

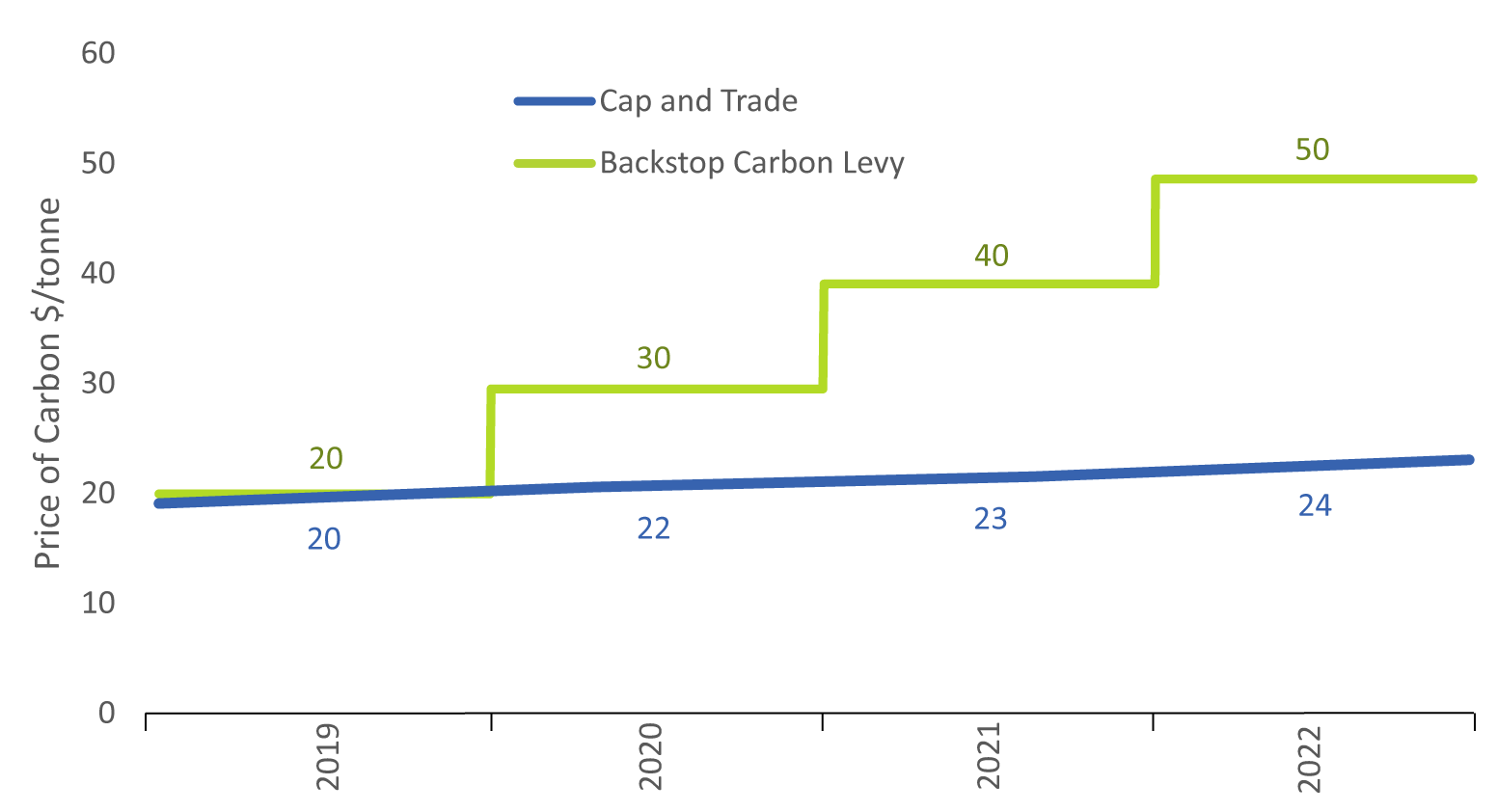

Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways. The federal carbon tax will cost a typical household 258year in 2019 and will rise to 648 by 2022. Quebec has a functioning cap-and-trade system and Ontario plans to launch one in 2016.

The cap and trade program is a central part of Ontarios solution to fight climate change. In Quebec and Nova Scotia the governments cap the amount of emissions theyll allow each year then hold quarterly auctions so companies can buy emissions credits within that amount. In addition to saving families money the elimination of the cap-and-trade carbon tax will remove a cost burden from Ontario businesses allowing them to grow create jobs and compete around the world.

The incoming premier of Ontario Doug Ford said he will move quickly to decouple the province from the trading program calling a carbon tax a bad deal for Canadians. The carbon tax system has been cited to both grow the economy.

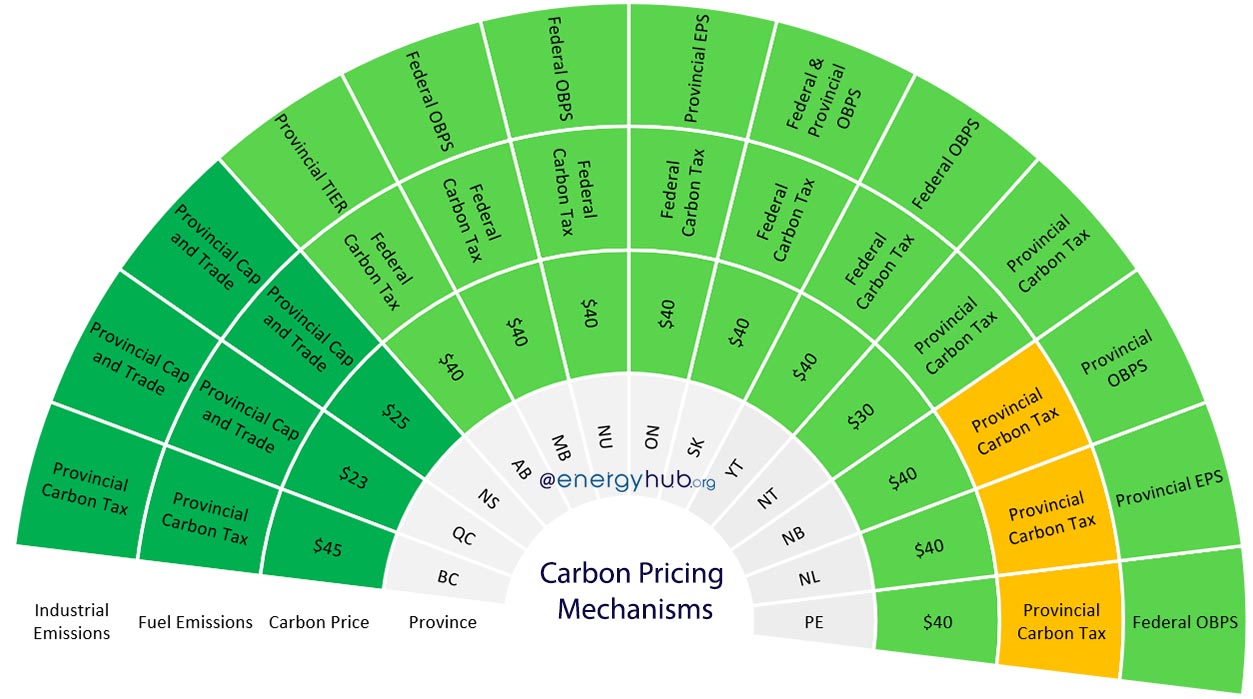

Your Cheat Sheet To Carbon Pricing In Canada Delphi Group

/cdn.vox-cdn.com/uploads/chorus_asset/file/13324429/1525091390644.png)

Canada S Justin Trudeau Is Betting His Reelection On A Carbon Tax Vox

Cap And Trade What Does It Mean For Your Organization Ppt Download

More States And Provinces Adopt Carbon Pricing To Cut Emissions Aceee

Carbon Pricing In Canada Wikiwand

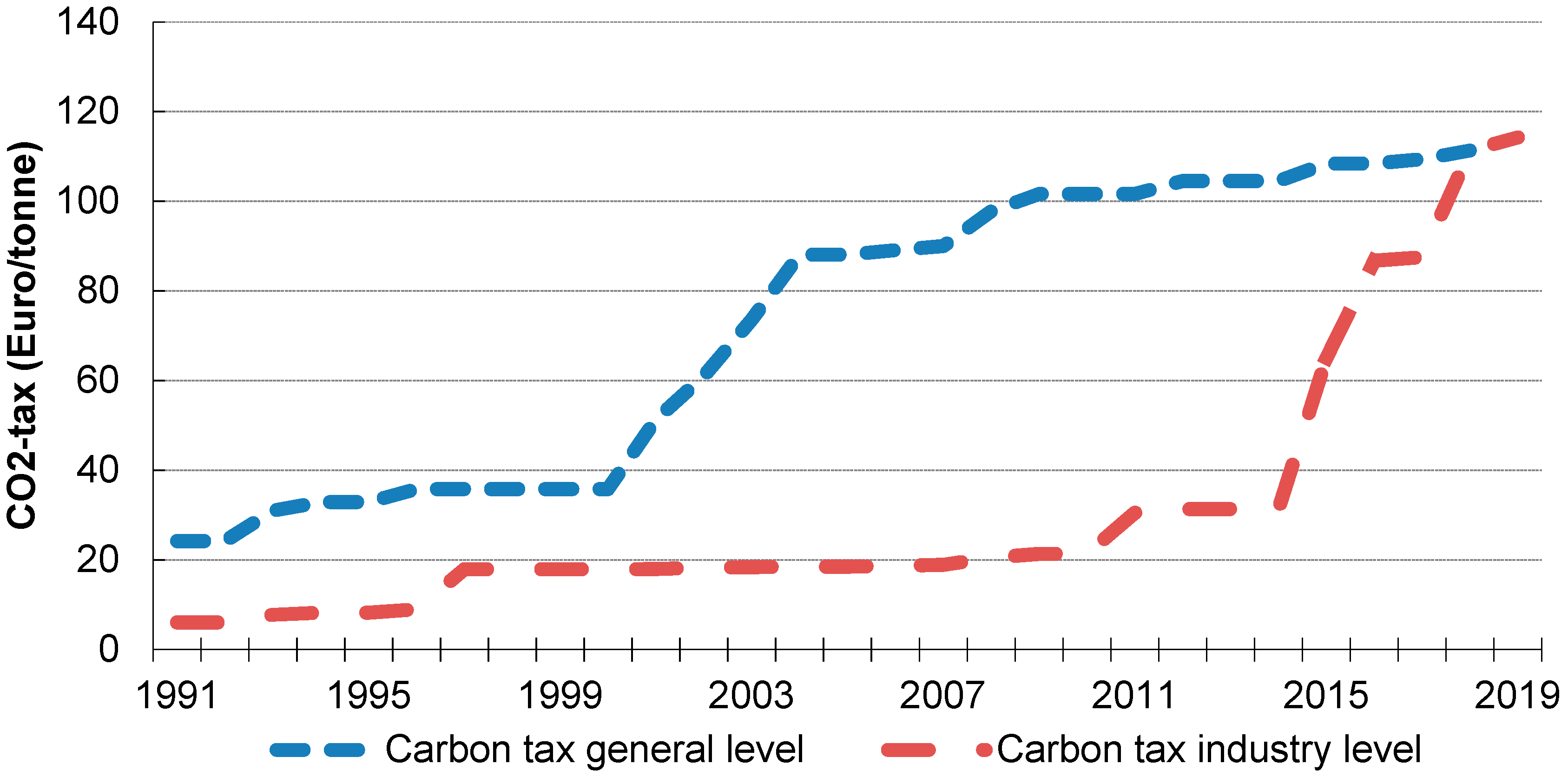

Sustainability Free Full Text Carbon Taxation A Tale Of Three Countries Html

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

Ontario Greens Parody Doug Ford S Anti Carbon Tax Stickers To Show Costs Of Climate Change Canada S National Observer News Analysis

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Carbon Markets Putting A Price On Carbon Green City Times

What Is Canada Doing With The Carbon Tax Money Ictsd Org

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

The Case For A Carbon Tax In Canada Canada 2020

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

Canadian Carbon Prices Rebates Updated 2021

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Canada S Carbon Pricing Is Continuing On The Right Track

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

All The World S Carbon Pricing Systems In One Animated Map Sightline Institute